There’s a lot of confusion around debt management – what it is, how it works, and whether or not it’s…

Do you know the most common credit card mistakes that people make? You might even be making them as well!…

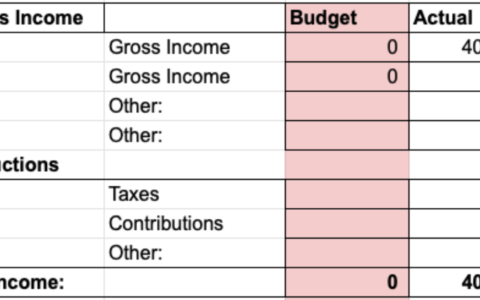

Are you failing to make your budget work? You’re not alone. A lot of people have trouble sticking to a…

If you’re feeling overwhelmed by your debt, you might be considering filing for bankruptcy. But before you take any drastic…

For many entrepreneurs, financial success is the ultimate goal. But achieving it can be difficult, especially if you’re not sure…

As the weather cools down and the holidays approach, many people find themselves spending more money than usual. Whether it’s…

Saving money on back-to-school shopping can be difficult. According to the National Retail Federation, Americans spent $37 billion on back-to-school supplies…

Are you struggling to budget on an entry-level salary? Many people may find it difficult to adjust to living on…

Including daycare expenses in your monthly budget can be a challenge, especially if you are not used to thinking about…