What is Bankruptcy & How does it work?

When people face overwhelming debt, they may begin to consider bankruptcy as an option.

There are different types of bankruptcy with their own specific requirements. Filing for bankruptcy can be a complex process, so it’s important to understand what it involves and how to go about filing bankruptcy.

What is Bankruptcy?

In the United States, bankruptcy is a legal process that helps people who can’t pay their debts get a fresh start.

Bankruptcy is a word that often comes up when people are struggling financially. The thought of bankruptcy can be scary, but what does it actually mean? And should you file for bankruptcy if you find yourself in debt?

Types of Bankruptcy

There are two common types of bankruptcies: Chapter 7 and Chapter 13. In a Chapter 7 bankruptcy, also called liquidation bankruptcy, the court discharges ( wipes out) most of your debts. In a Chapter 13 bankruptcy, also called reorganization bankruptcy, you create a payment plan to repay some or all of your debts over time.

Chapter 7 Bankruptcy

Chapter 7 bankruptcy is also known as liquidation bankruptcy. It is the most common type of bankruptcy, and it involves the sale of all of your assets to pay off your creditors.

Facts about Chapter 7 bankruptcy:

- For one thing, it will stay on your credit report and public records for up to 10 years, which can make it difficult to get unsecured credit in the future.

- Chapter 7 bankruptcy will also likely result in the loss of some of your assets, including your home and your car if you do not pass the means test. This type of bankruptcy is good if you do not own assets.

- Chapter 7 bankruptcy could cost you over $1,500. Before filing, contact a bankruptcy attorney to get the exact price of fees for the state you reside in.

- Chapter 7 bankruptcy can be stressful and emotionally devastating, so it is important to consider all of your options before making a decision.

Qualifying for Chapter 7

In order to qualify for Chapter 7 bankruptcy, you must pass the Means Test. The Means Test is a calculation that looks at your income and compares it to the median income in your state.

If your income falls below the median, you automatically qualify for Chapter 7 bankruptcy.

Chapter 13 Bankruptcy

Chapter 13 bankruptcy is also known as wage earner’s bankruptcy. This type of bankruptcy allows you to keep your property and repay your debts over time, but it requires you to have a regular source of income to make the payments. This is what we consider a court-ordered debt settlement plan because it is up to the trustee on what you pay.

Facts about Chapter 13 bankruptcy

- As of late 2021, Chapter 13 bankruptcy has a failure rate of 67% according to upsolve.org

- If your chapter 13 case gets dismissed then you could end up owing more money than before you started

- Chapter 13 bankruptcy stays on your credit report for 7 years.

- You are still paying back all your debts in full just with a court order making sure you stay on top of it.

- It can cost over $3,000 to file for Chapter 13 bankruptcy, but please check with your local bankruptcy attorney.

Qualifying for Chapter 13

To qualify for Chapter 13, you must have a regular source of income and debt totaling less than $394,725 for unsecured debt, such as credit cards or medical bills, or $1,184,200 for secured debt, such as a mortgage or car loan.

You must also have filed all required tax returns for the past four years. If you meet these criteria, you will work with a bankruptcy trustee to develop a repayment plan that meets the requirements of the bankruptcy court. This could also mean you will be repaying some or all of the balance depending on your income.

Other Types of Bankruptcy

Chapter 11 Bankruptcy

Chapter 11 bankruptcy is also known as a reorganization bankruptcy. This type of bankruptcy allows you to keep your business or property, but you must reorganize your finances and repay your debts over time.

Chapter 12 Bankruptcy

Chapter 12 bankruptcy is designed specifically for farmers and fishermen. It allows them to restructure their debts and gives them some relief from creditors.

No matter what type of bankruptcy you choose, It is important to speak with a bankruptcy attorney if you are thinking about filing.

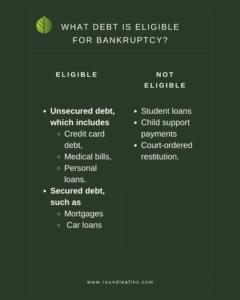

What debt is eligible for Bankruptcy?

Several types of debt can be discharged through bankruptcy.

In addition, bankrupt individuals typically are required to repay a portion of their debts through a repayment plan.

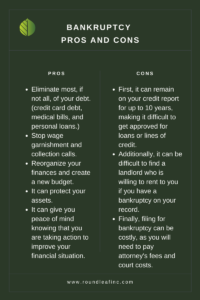

Bankruptcy Pros and Cons

Many people dread the idea of filing for bankruptcy, but the truth is that bankruptcy can be a helpful tool for managing unmanageable debt. When done correctly, bankruptcy can provide a fresh start and much-needed relief from creditors.

In some cases, you may also be required to surrender some of your assets, such as your home or car.

How to file for Bankruptcy in California

Filing a Petition

In California, filing for bankruptcy typically begins with the debtor filing a petition with the court. The petition must include detailed information about the debtor’s finances, including a list of creditors, asset values, and income levels.

Automatic Stay Is In Place

Once the petition is filed, the court will issue an automatic stay, which prohibits creditors from taking any action to collect on their debts.

Meet with Creditors

After the automatic stay is in place, the debtor will need to attend a meeting of creditors, during which creditors can ask questions about the debtor’s finances and decide whether to object to the discharge of any debts.

- If no objections are raised, the court will likely approve the debtor’s bankruptcy plan and discharge their debts.

- If objections are raised, the court may require the debtor to modify their plan or even dismiss their case altogether.

Because of this, it is important to speak with an experienced bankruptcy attorney before moving forward with any type of bankruptcy proceedings in California.

How to rebuild your credit after Bankruptcy

Rebuilding credit after bankruptcy can seem like a daunting task, but it is possible to get your credit score back up to where it was pre-bankruptcy.

- The first step is to make sure that all of the debts included in the bankruptcy have been discharged.

- Then, you can start working on reestablishing credit by opening a new credit account and making all of your payments on time.

- Another important step is to keep your credit utilization low, which means using less than 30% of your available credit.

- You can also help improve your credit score by regularly monitoring your credit report for errors and disputing any inaccuracies that you find.

By following these steps, you can eventually rebuild your credit and get back on track financially.

Alternatives to Bankruptcy

Before you decide to file for bankruptcy, you must know all your options. Depending on your financial situation, there may be alternatives to bankruptcy to help you get back on solid ground.

Debt Consolidation

One option to consider is debt consolidation. If you have multiple debts from different creditors, consolidating your debts into one loan can make it easier to manage your payments and may help you qualify for a lower interest rate. You can consolidate your debts by taking out a personal loan or using a balance transfer credit card.

Credit Counseling

Another option is to work with a credit counseling agency. A credit counselor can work with you to create a budget and negotiate with your creditors to try to lower your interest rates or waive late fees. Credit counseling services are typically offered for free or at a low cost.

Find a different way to pay it off

If you own assets such as a home or a car, you may be able to sell them and use the proceeds to pay off your debts. This option should be used as a last resort, as it will likely damage your credit score and leave you without transportation or a place to live.

However, if you’re facing foreclosure or repossession, selling your assets may be the best way to avoid those consequences.

Bankruptcy should always be considered as a last resort option. If you’re struggling to make ends meet, take some time to explore all of your options before making any decisions. With careful planning and some patience, it may be possible for you to avoid bankruptcy and get back on track financially.

Considering Bankruptcy?

Bankruptcy is not the only solution for those struggling with debt. There are many programs and options available to help people get out of debt without having to file for bankruptcy. If you’re feeling overwhelmed by your debts, take some time to research your options and find the program that best suits your needs.

Don’t be afraid to ask for help – there are plenty of resources available to guide you through the process. Are you ready to start getting your financial life back on track?

Bankruptcy FAQs

Does Bankruptcy show up on a background check?

Bankruptcy does show up on a background check. Chapter 7 Bankruptcy will stay on your public record for up to 10 years. Chapter 13 Bankruptcy stays on your record for 7 years.

How long does it take to file Bankruptcy?

For Chapter 7 bankruptcy, it’ll typically take around four to six months. But for Chapter 13 bankruptcy, it can take up to three years.

Can Bankruptcy stop eviction?

Bankruptcy can stop eviction if it’s filed before the eviction process begins. If the bankruptcy is filed after the eviction has already started, it’s unlikely that the filing will be able to stop the eviction.

Does Bankruptcy clear child support?

No. Bankruptcy will discharge most debts, but not child support. Child support is a priority debt and will continue to be owed even if you file for bankruptcy.

Can Bankruptcy stop repossession of a vehicle?

When you file for bankruptcy, an “automatic stay” is put into place. This means that your creditors are no longer allowed to contact you or take any collection action against you. This includes repossessing your vehicle.

How much debt do you need to file Bankruptcy?

In the United States, for example, you can file a Chapter 7 bankruptcy with relatively little debt, as long as your income is low enough that you pass the means test. On the other hand, if you want to file a Chapter 13 bankruptcy, you generally need at least $10,000 in unsecured debt and $5,000 in secured debt.

Does filing Bankruptcy affect your spouse?

Yes, it can. In some cases, both spouses are liable for the debts incurred during the marriage. In other cases, only the spouse who incurred the debt is liable.