Rebuild Your Credit Educational Programs

For many people, good credit is a critical part of building and maintaining an excellent lifestyle. Unfortunately, the traditional ways that you might think about improving your score don’t always work for everyone—especially those who are younger or haven’t had much experience with managing their finances before now!

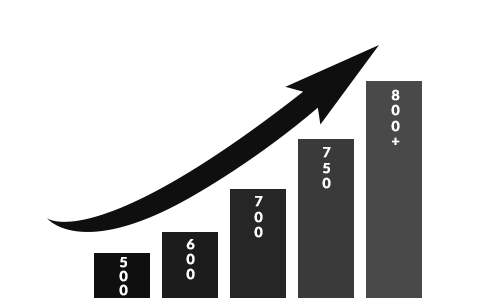

We’re here to help you get your credit back on track! We provide programs that guide you through the process and teach how best practices for managing FICO scores. It doesn’t matter what stage of rehabilitation it is, we’ve got an option just right for you – whether it’s restoring good standing or starting from scratch! We’ve also partnered with the industry leader in credit restoration that is designed with your goals in mind.