Debt Settlement

If you’re feeling overwhelmed and struggling with high debt payments, we want to help! The stress of worrying about creditors coming after the money owed can be enough for some people.

Many people face a financial crisis at some point in their life. From personal and family health issues to job loss or overspending your budget — you are not alone. We know it is overwhelming, and you need to know there is help.

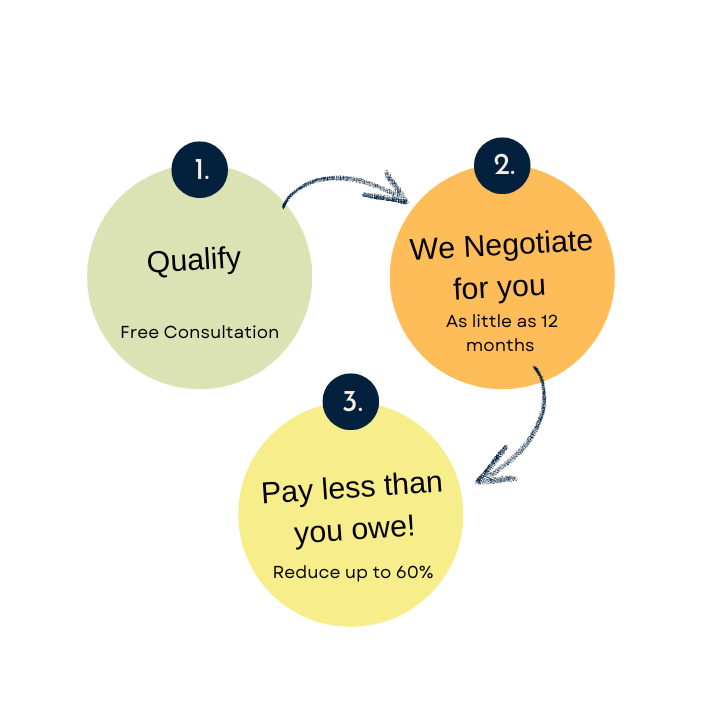

When it comes to debt, there’s no such thing as a one-size-fits-all solution. That’s why debt settlement could be the right choice for you.