How Does Credit Score Affect Interest Rates?

Your credit score is the primary factor in determining the interest rates creditors will charge you. Your credit score, good or bad, reflects your credit history. So the higher your credit score, the less of a risk you pose to the lender. If you have a low credit score, creditors will charge higher interest rates, along with fees and deposits, to compensate for the risk of you potentially defaulting on the loan or missing payments.

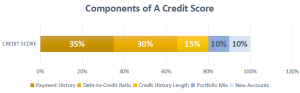

Credit Score & its Components

-

Perfect credit score: 850

-

Excellent rating: 740-849

-

Good credit score: 700 to 739

-

Fair score: 650 to 699

-

Low score: 649 and below

There are 5 components that make up a credit score and determine how a creditor views your credit score. These 5 components of a credit score include payment history, debt to credit ratio, the length of your credit history, your portfolio mix (all your assets put together), and any new credit accounts that you may have. To understand what components have a higher impact you can refer to the photo on the right. It shows the components and percentage of impact each component has when viewed by the creditor.

-

35% – Payment history

-

30% – Debt to credit ratio

-

15% – Credit history Length

-

10% – Portfolio mix

-

10% – New accounts

So why should you care about having higher interest rates?

The Pain of Higher Interest Rates

Why should you worry about higher interest rates? In one word, money. Lots of money. The difference between an interest rate of 1% or 2% doesn’t sound like much. Sometimes it doesn’t even make that much of a difference on your monthly payment. But every one percent increase on a $100,000 loan is equivalent to $68,000 in interest payments. In today’s market, if you have a FICO score of 680, you will pay almost two percentage points more on your interest rate. That could mean a difference of almost $200,000 in interest payments over the life time of your loan. What would you do with $200,000?

Qualify for Better Rates

Maintaining an excellent credit rating is the only way to obtain the best interest rate when purchasing anything big or small. So it’s important to understand FICO score risk factors. Contact Roundleaf Inc. to see how we can help you raise your credit score and qualify for better financing!