5 Steps to Debt Management

Before you learn about debt management, you must first realize that having debt is common. It’s not your fault. It’s not a fault at all.

Let our self-help guide take you through the process of debt relief — one step at a time.

The 5-Step Debt Management Plan to Get Rid of “Too Much” Debt

There is debt, and there is “too much” debt. A healthy balance between debt and credit keeps you closer to your goals without compromising on finances. But if you are broke before two-three weeks of clearing your paycheck, then you are suffering from excessive debt. It’s time to re-evaluate your debt situation. Aligning with a Debt Management Plan (DMP) is your best option for becoming debt-free and rid of multiple debts.

A Debt Management Plan is nothing but an actionable insight into your finances. A soundly laid out DMP accounts for:

STEP 1 | Make A Spending Plan & Stick to It

The first step towards eradicating debt is to spend wisely.

-

Identify your most essential expenses (Utilities, food, and shelter). Don’t forget to add your quarterly/half-yearly expenses as well (taxes, insurance, etc.) car loan, expenses, and student loan debt.

-

Prioritize your expenses. Strip the list down to the bare minimum, and then work your way up. It may be difficult to distinguish between essentials and luxury at the beginning. But, being debt-free requires determination and discipline.

-

Economize your expenses as much as possible. Revisit the list by adding a new column to reflect modified costs. Stick to essential usage and restrict yourself from adding more to the list until your debts are manageable.

The final list should look like this:

| Payment for… | Current Cost | Reduced Cost | Payment Date | Pay to… | Pay from… | |

| 1. | Rent | $XXX | $YY | XX/XX | Payee Name | Bank A/C number |

| 2. | Electricity | $XXX | $YY | XX/XX | Payee Name | Card No. |

| … | … | … | … | … | … | … |

Tip: It is a good practice to count Savings amongst your essentials. Learn to save first.

STEP 2 | Take Full Stock of Your Monthly Debt Payments

If you notice carefully, it is not the actual amount of debt but the monthly payments that hurt the most. Monthly payments are calculated with three parameters:

1) Principal

2) Annual Interest Rate, and

3) Number of Instalments due.

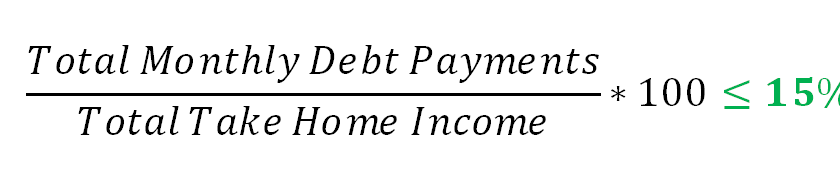

Create an estimate of your total monthly debt payments.To tell whether you have too much debt, you need first to determine the percentage of your take-home pay that you are using to pay off consumer debts. [Consumer debts are the ones with which you buy things that depreciate in value over time, like clothing, accessories, food, gifts, car etc.

List all your take-home income (income that you can spend). Divide your monthly debt payments by this. While there is no magic number to how much debt is enough, average studies show that monthly debt payments more than 15% of the take-home income are harder to manage.

Tip: Mark Revolving Credits in red in your debt list. Lenders tend to obscure interest rates and no. of installments in these sorts of credits. Interest rates may vary too. So you may end up paying much more for the loan. Credit cards often use revolving credit.

STEP 3 | Repay, Reduce & Re-focus Your Debts

Repay:

Let’s take an example of a credit card debt of a total of $10,000 that you want to pay in 36 months (3 years). Calculating interests on an average APR of 20%, you’d have to pay close to $400 every month to repay your debt within 3 years fully.

| Balance | APR | Monthly Payment | Payoff Time |

| $10,000 | 20% | $371.64 | 36 months |

Since your debt comes down to 0% of your monthly income (full repayment), this monthly installment amount is the highest you need to pay per month.

Set a deadline to bring your debt down to a manageable level (say, 10% of your take-home income). Now, once you get the total of your overall debts, you can equate the monthly installments in the same way. This will be the minimum amount you have to pay each month.

Your equated monthly installments (EMIs) need to hover somewhere between the highest and the lowest amount.

Reduce / Refinance:

If this monthly debt payment is too high for you, there is one of three ways you can lessen it:

1) reduce the principal you want to repay through the plan,

2) assign a lower interest rate, or

3) extend the payment timeline.

Unfortunately, all these parameters are decided by your creditor, and the first one (principal) is non-negotiable. You have to negotiate a refinance loan from them.

Refinancing is NOT debt consolidation. It’s merely changing the debt agreement with the lender.

Re-focus:

Speaking about debt consolidation, it’s not such a great idea. Not only do you lose control over your debts to a third party, but there is also the risk of losing credit scores over late payments, charge-offs from your original debts.

Compared to that, it’s better to re-focus your debt payments.

- Diligently Divide your debts into ‘more important’ and ‘less important’ categories.

- Calculate how much time you need to pay off more essential debts.

- Use refinancing to reduce the initial monthly payments of less essential debts.

- Focus the majority of your monthly payments on paying off important debts first.

- Once the essential debts are checked off, don’t decrease the total EMI amount.

- Use this fixed amount to pay off your other debts quickly.

Tip: Always try to repay more than the minimum monthly balance. This way, you have to pay lesser interests on recurring debts. Your credit history also improves.

STEP 4 | Need help with debt management

When do I ask for help?

You may have lost a step to repay your debts due to disasters, financial emergencies, poor spending habits, loss of jobs, or investment failures that cause a debt avalanche. All may seem lost. But before asking for help, try to reason with your situation first. Ensure that you have tried everything before reaching out. Though abundant in the market, professional debt management doesn’t come cheap.

Ask yourself:

- Is my financial loss a one-time thing or due to a recurring habit?

Debts accumulated due to poor financial habits like taking loans repeatedly, late payments can often attract the ire of creditors. Handing them over to third parties only increases your chances of penalties and costs you more than what you owe.

- Is my debt below 15% of my annual income?

It is advisable to ask for professional help only when your debts are within 15-39% of your annual income. Any lower than 15%, the cost of management does not justify the debt. Any higher than 40% and you can file for bankruptcy.

- Do I have enough buffer to sustain a long haul?

Professional debt management programs last for an average of 3-5 years. Once in it, you cannot open or use new lines of credit to save yourself for any other financial crisis. If you do, then you lose all the concessions due to the DMP and incur heavy penalties.

Who can help me get out of debt?

Do It Yourself:

Negotiating with creditors is not easy; to say the least. But despite your inexperience as a negotiator, you have the best understanding of your debt situation. Some technical tips to help you out in the process:

- Know Your Options: Go through your income and expense sheets thoroughly before the call/meeting. Know exactly what your options are: what you can afford, and definitely what you cannot.

- Stick to the Story: Do not get lost in the narrative. Creditors generally look for consistency, not your tale of woes.

- Keep It Interactive: Pay 100% attention to the other person. Ask questions that make sense, take notes. You never know, some valuable nugget may fall your way.

- Avoid Escalations: Work out your agreements with the creditors. Do NOT let your calls escalate to collectors. The humiliation and damage are far greater.

- Redact Late Payments: Late payments, charge-offs, and collection accounts can stay on your credit report for 7+ years. Reach an agreement to remove these from your credit report.

- Get Everything in Writing: Keep a thorough record of every communication (calls, mails, receipts, bills, documents) with your creditor. Pay only when you have the final payment agreement in writing.

- Take Professional Help: If you’re uncomfortable with the agreement, sit with counseling agencies for a free consultation.

Credit Counselling Agencies:

Loss of credit reputation is also a loss for your real-world status in front of creditors. They simply don’t trust “deadbeat” debtors to give them a second chance. They might, though, hear your case from reliable credit counseling agencies. Consumer credit counselors can negotiate with lenders for better interest rates, extend the number of payments, and even consolidate your debts. However, this move will come at a loss of credit score.

Bankruptcy Attorneys:

Going bankrupt is a serious issue. Filing for personal bankruptcy reflects on your credit report for at least ten years, and you lose about half of your credit score. Bottom line: you wouldn’t be able to borrow money from anywhere in the market. Do not take it lightly and keep it ONLY as a last resort.

But if you have no other option, you must seek professional help. Try local. Find trusted bankruptcy attorneys within your community. Ensure that your safety from creditors is iron-clad. Check whether they want to go for liquidation or restructuring for debt. Prepare for the Creditor Meeting (341) diligently.

Tip:Be wary of which professional agencies you seek for help. Debt management scams are abundant in the market. Debt relief funds, credit repair services, fake debt settlers are some of them.

STEP 5 | Rebuild Your Credit Reputation

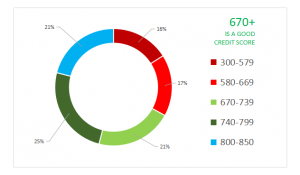

Mismanaged multiple debts can affect your credit score badly. On the other hand, a good credit score can better your chances to manage debts with lower interest rates and creditor trust. So you must repair the damages borne to this vital financial asset once your debts are on their way to absolution.

Check Your Credit Report at least once every year.

- Download your free credit report from Experian, Equifax, or TransUnion.

- See where you stand at the credit rankings after applying debt management. Check YOY progress.

- Report false data on the report. Check whether adverse credit history is being expunged or not.

- Collect reports from all three credit agencies if you are denied credit based on the report.

Analyze what’s affecting your credit score.

- Have you had any hard inquiries on your credit accounts recently?

- Are late payments still showing on your credit history?

- Is your credit history lesser than that of six months?

- Is your secured credit card showing in the report?

- Is your debt-to-credit utilization above 30%?

Know more about credits and how they impact your overall financial health. Enlist to Roundleaf’s 100% debt-free commitment. Talk to our experts today for a free consultation to help you with your financial situation.